Have you ever wondered whether to use recurring donations or opportunity payments when capturing donations in the Non-Profit Success Pack? This blog posts suggests three questions you should consider before selecting an option.

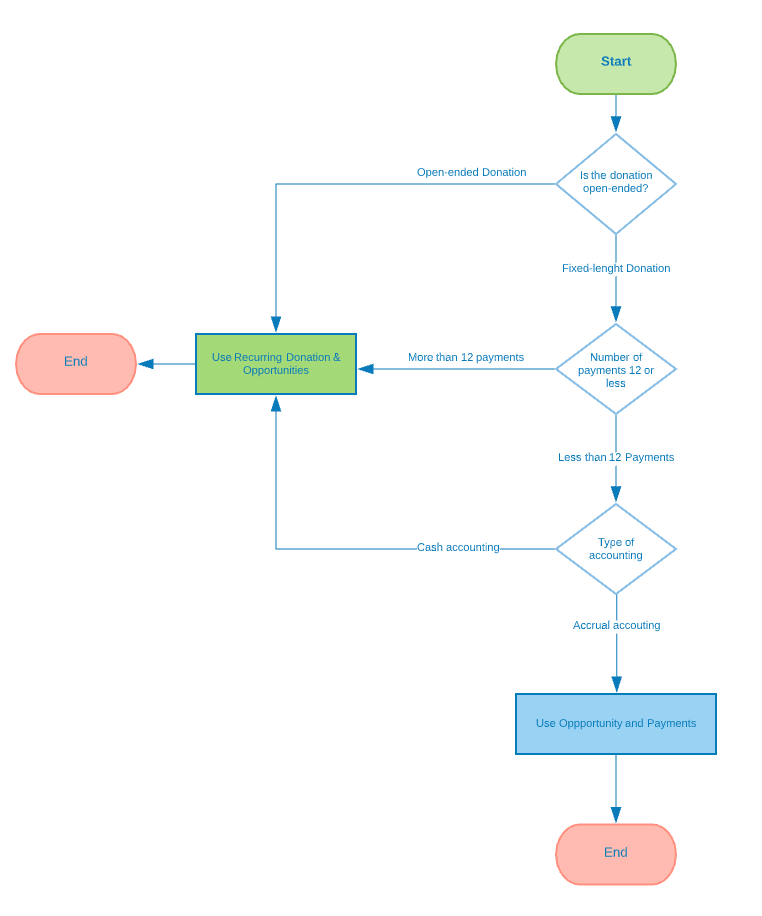

If you are short on time, this diagram below conveys the key message.

These are 3 Questions to consider:

1. Is the donation open-ended?

2. Is the anticipated number of payments more than 12?

3. Does your company use cash accounting or accrual accounting method?

1. Is the donation open-ended?

If a donor has signed-up to give regular donations indefinitely such as regular monthly payments, then it is best practice to use the Recurring Donation (with opportunity and payments) and not only the Opportunity Payments to capture this. The main reasons are:

- Reduce administrative overhead: You can easily create and close the Recurring Donation record. This would automatically create or update child opportunity records and their respective child payment records. When you mark a recurring donation record as closed, NPSP will update all related future opportunities and payment records – future opportunity records will be marked as “closed lost” and their related payment records will be marked as “written off”.

- Limitations of using only Opportunity Payments: there is a fixed maximum limit of 12 payments on an Opportunity record in the NPSP. If the number of instalments required is not known and you use Opportunity Payment, you would have to manually create another opportunity when the opportunity’s child payments records exceed 12. However, if the donation’s payment period has a fixed length then you should consider question 2.

2. Is the Number of Payments to be made 12 or less?

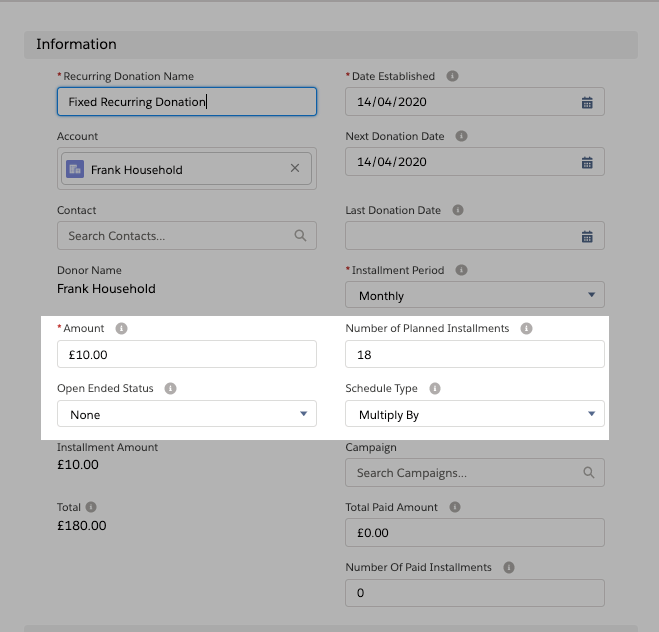

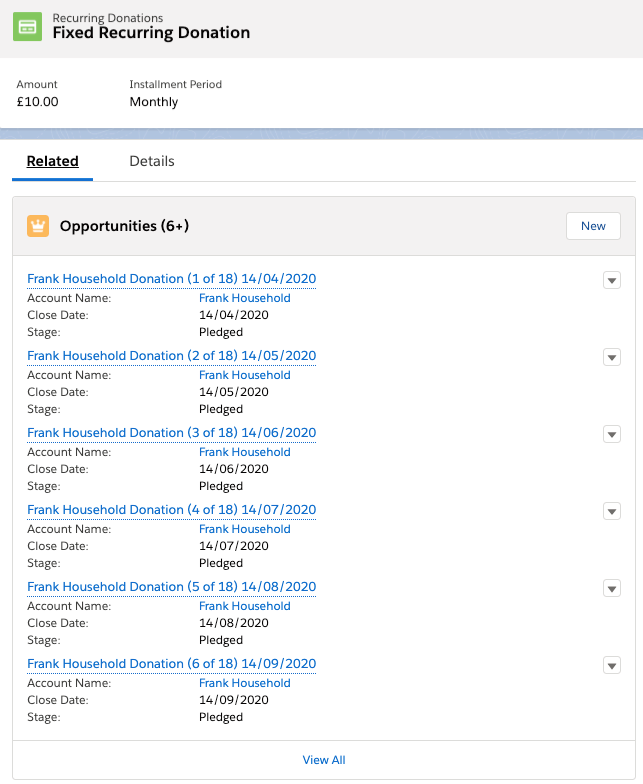

If the donation’s payment period has a determined time frame and number of payment instalments for the donation is more than 12, such as a regular payment each month over an 18 month period, then it is best practice to use the Recurring Donations, for the same reasons mentioned in 1 above. When you create the Recurring Donation, you can either:

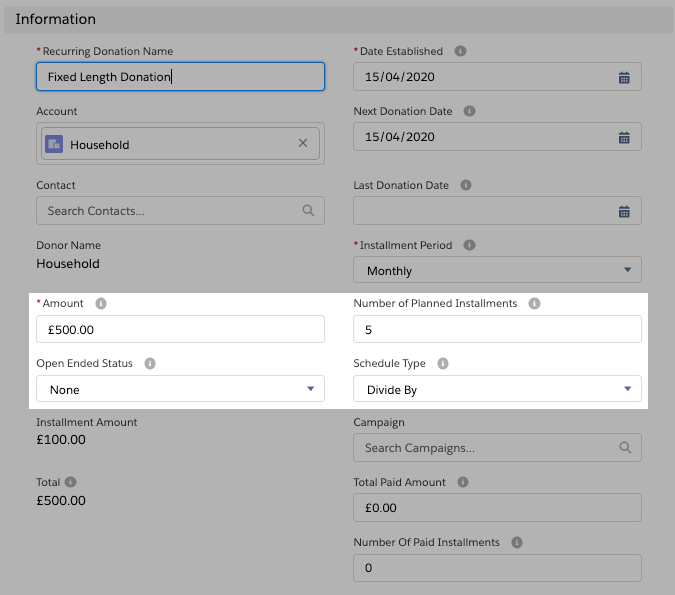

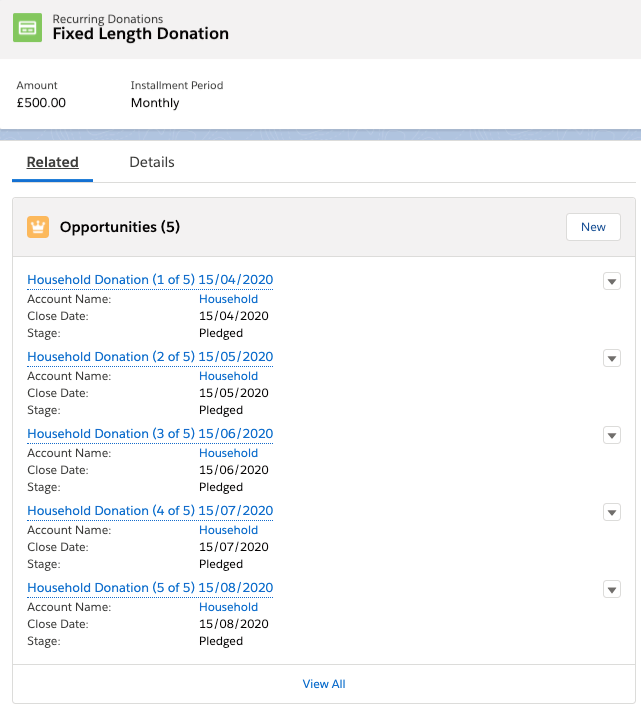

- specify the figure you expect for each payment in the Amount field, specify number of planned instalments and select “Multiply By” in the Schedule field, and. As shown in the images below, this will automatically create 18 opportunity records, each with an amount of £10.

- or, specify the total figure you expect to receive in the Amount field, specify a the number of planned instalments and specify “Divide By” in the Schedule field, and. As shown in the images below, this will automatically create 5 opportunity records, each with an amount of £100.

3. Does your company use cash accounting or accrual accounting method?

What is cash accounting or accrual accounting?

According to NPSP documentation: Cash accounting refers to when all income and expenses are recorded when the income is received or the expenses are paid. Whereas, Accrual accounting refers to when all income and expenses are recorded when they are incurred, not when they are received or paid. For example, you would report your income when the money is pledged—not when it’s received. Likewise, you would report your expenses according to the date of the bill, not the day you pay the bill.

Suppose the donor declared the number of payments she would like to make; or if she declared the length of period over she wants to give (for example, one payment in each month over the next 3 months), then the way you choose to capture the donations would depend on your accounting method.

If your company uses Cash Accounting it is best practice to use the Recurring Donations. If your company uses Accrual Accounting it is better to use the Opportunity Payments.

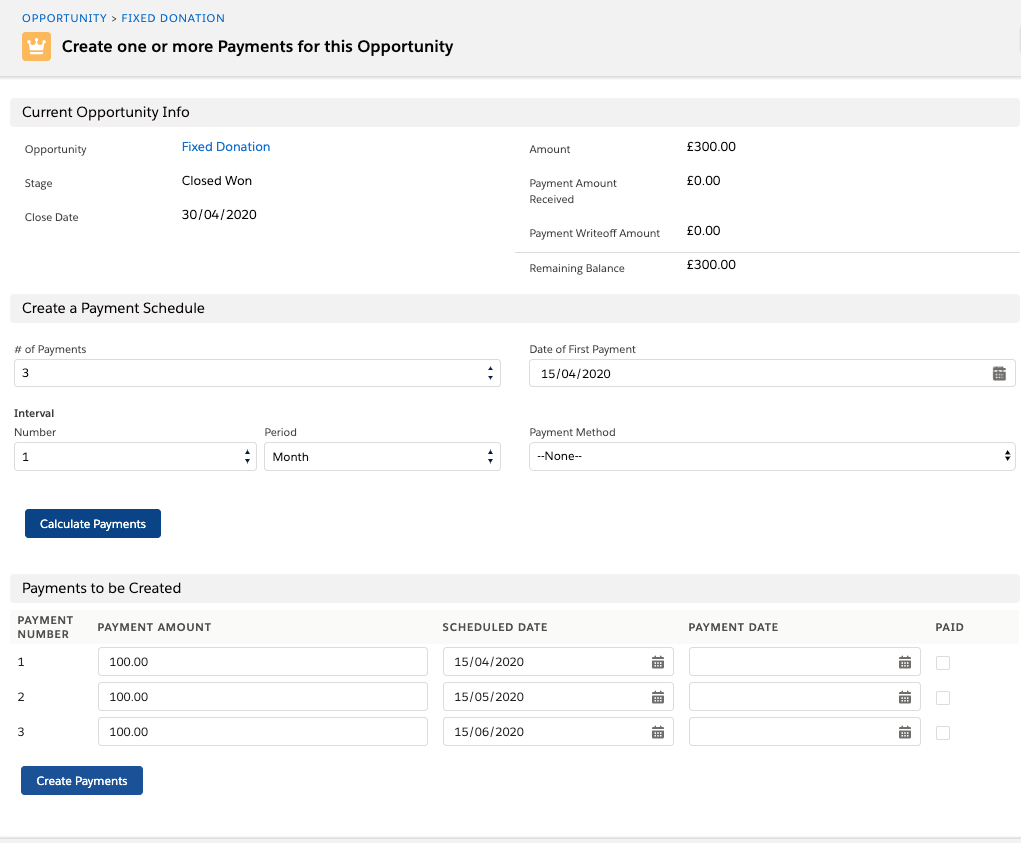

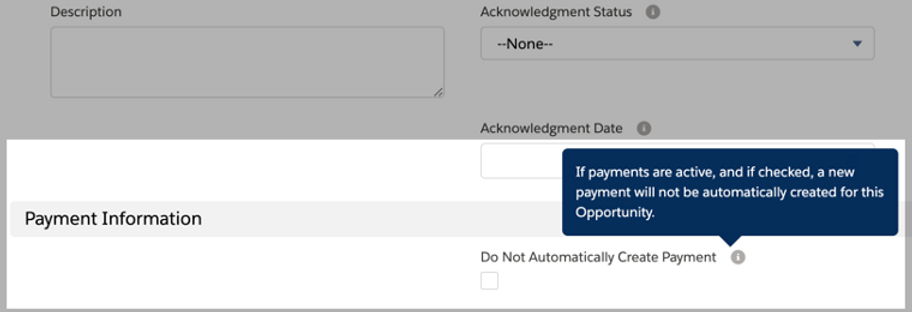

When using Opportunity Payments, remember to set the “Do Not Automatically Create Payment” flag as true on the Opportunity method. This will ensure that a singular corresponding payment record is not automatically created when you create the Opportunity. You can use the schedule payment to create multiple child payments records, as shown in the images below.

What if the donation is a one-off payment? Then it is best practice to create an opportunity donation record with a singular payment record especially if your organisation uses a Cash Accounting method. Remember to leave the “Do Not Automatically Create Payment” flag as false (see image below). This will ensure that a corresponding payment record is automatically created.

In Summary, these 3 questions should be part of your considerations when deciding whether to use Recurring Donations vs. Opportunity Payments:

1. Is the donation open-ended? If yes, Recurring Donations is recommended.

2. Is the anticipated number of payments more than 12? If yes, Recurring Donations is recommended.

3. Does your company use cash accounting or accrual accounting method? If cash accounting, Recurring Donations is recommended, otherwise Opportunity Payments.

There are other perspectives to consider as well, that will be the topic of another blog post!